Cybersecurity testing solution giant Darktrace has agreed to be sold to Thoma Bravo, a U.S.-based private equity firm that is one of the world’s largest investors in software companies.

Darktrace, which made its breakthrough by flooding the testing and cybersecurity solution market with a range of AI testing products and other tools in recent years, revealed it had negotiated a deal that values the company about 44% higher than its average share price over the last quarter.

The provider of a range of cyber-related testing tools said Chicago-based Thoma Bravo will pay just over $5.3 billion for the Cambridge, UK-based company as both parties agreed to value the firm at $7.75 per share, or about 620 pence.

This is significantly higher than when the company went public in 2021 at the London Stock Exchange (LSE), at 250 pence a share.

Darktrace explained in a statement that the offer from Thoma Bravo would give its shareholders “certainty about the value of their shares and enable the company to grow in a stable and private setting”.

Testing solutions

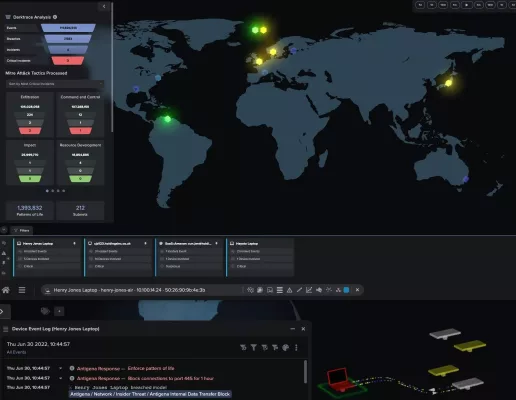

Darktrace’s AI-powered tools aim to scrutinise and monitor software infrastructure for risks, flaws, cybercrime vulnerabilities, potential attacks as well as external threats.

The Darktrace board, led by CEO and co-founder Poppy Gustafsson, wrote in a letter to investors that “from our base in Cambridge, we are building a world-leading company using a unique form of artificial intelligence to address the societal challenge of cybersecurity.”

With regards to the deal, Gustafsson said that “the proposed offer represents the next stage in our growth journey, and I am excited by the many opportunities we have ahead of us. Our testing technology has never been more relevant in a world increasingly threatened by AI-powered cyber-attacks.”

Through its Darktrace Prevent, Darktrace Detect and DT Attack Surface Management solutions, the company provides ‘round the clock’ testing services to a range of industries, including banking and finance.

The firm serves dozens of banking clients and other financial services players, such as insurance firms, asset management and central banks, mostly in the UK and Europe.

“In the face of this, we are expanding our product portfolio, entering new markets, and focused on delivering for our customers, partners and colleagues,” Gustafsson wrote.

The agreement offers Darktrace an opportunity to push further into the U.S. market. Darktrace has been active in North America for years, but its market share in the cybercrime and testing market has, so far, been relatively modest.

“Our testing technology has never been more relevant in a world increasingly threatened by AI-powered cyber-attacks.”

– Poppy Gustafsson

The deal does mean the company is going private, thereby leaving the London Stock Exchange, its public home since 2021.

Gustafsson fired a parting short at the LSE, writing in a letter to investors that “operating and financial achievements have not been reflected commensurately in its valuation, with shares trading at a significant discount to its global peer group.”

U.S. expansion

The multi-billion dollar takeover will help Darktrace to further penetrate the U.S. market as it is expected Thoma Brave plans to integrate the AI firm’s testing tools and other cyber-related products into its vast portfolio of software and cybersecurity companies.

Thoma Bravo is one of the world’s largest investors in software firms. At the end of last year, it had more than $138 billion in assets under management, comprising a vast portfolio of software solution and development companies.

The firm has been eyeing Darktrace for years but walked away from a previous takeover in 2011 when Gustafsson said the private equity investor had “severely undervalued” her firm.

Despite talks collapsing three years ago, Thoma Bravo partner Andrew Almeida pointed out today that “we have long been admirers of Darktrace’s platform and capability in artificial intelligence.”

He added the acquisition makes sense as “the pace of innovation in cybersecurity is accelerating in response to cyber threats that are simultaneously complex, global and sophisticated. Darktrace is at the very cutting edge of cybersecurity technology.”

The deal is expected to close before the end of this year.

Stay up to date and receive our news, features and interviews for free

Our e-newsletter lands in your inbox every Friday. Sign up HERE in one simple step.

ON MAY 15 IN NEW YORK CITY

DO NOT miss our upcoming Financial Forum in New York City.