Global payment tech company Mastercard is rolling out its own generative articifical intelligence platform to allow banks to better spot suspicious and fraudulent transactions.

The tool, called Decision Intelligence Pro, is powered by a generative AI technology, namely a proprietary recurrent neural network.

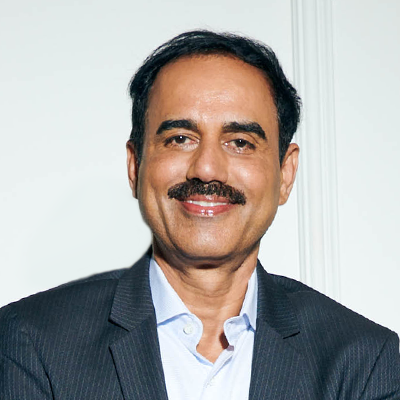

The new platform can increase fraud detection rates by up to 300%, claimed Mastercard’s president of cyber and intelligence business, Ajay Bhalla.

Decision Intelligence Pro works in real-time and is able to determine whether payments or transactions are legitimate, he explained

Bhalla said that Mastercard, which serves thousands of banks around the world, decided to develop its own AI tool to serve its banking customers better as “the increasing number and sophistication of scams, imitating people or genuine goods and services, diminishes the trust in our digital ecosystem.”

He stressed the platform was entirely built in-house by the company’s own global cybersecurity team.

“We are using the transformer models which basically help get the power of generative AI,” Bhalla pointed out.

‘Heat-sensing radar’

The tool is developed in a way that it understands the relationship between the merchants better, with a large focus on language models such as OpenAI’s GPT-4 and Google-run Gemini.

It is designed to recognise and predict when fraudulent or suspicious transactions are offered to the network, Bhalla said.

Rather than using words or text, the Mastercard platform turns to the history of a cardholder’s merchant visit “to determine whether the business involved in a transaction is a place the customer would likely go,” he continued.

It then creates pathways through Mastercard’s network, similar to “a heat-sensing radar”, as Bhalla put it, and formulates a score.

The lower the score, the more the platform believes a payment should be marked as suspicious. The entire process takes about 50 mili-seconds.

“Our AI’s alghoritms use proprietary data from close to 125 billion transactions that are processed by Mastercard each year.”

Ajay Bhalla, Mastercard

Bhalla declined to give details about the platform’s investment allocations, but he did say Mastercard invested around $7 billion in AI technologies in the last five years.

“It’s all built in house we’ve got all kinds of data. Because of the very nature of the business we are in, we see all the transaction data which comes to us from the ecosystem.”

Currently, Mastercard relies on open source but is increasingly moving towards its own in-house tech, Bhalla concluded.

ALSO READ

- LambdaTest launches tool that runs tests directly into browsers

- Chaos engineer Steadybit raises millions in fresh funding

- Exclusive sitdown with IAR’s newly appointed CEO Cecilia Wachtmeister

- Xceptor poaches Keith Man from Duco to drive APAC growth

- Yethi rolls out codeless test ‘workbench’ for large QA teams