Test automation giant Mabl has developed and rolled out a new mobile app testing platform, the company shared with QA Financial.

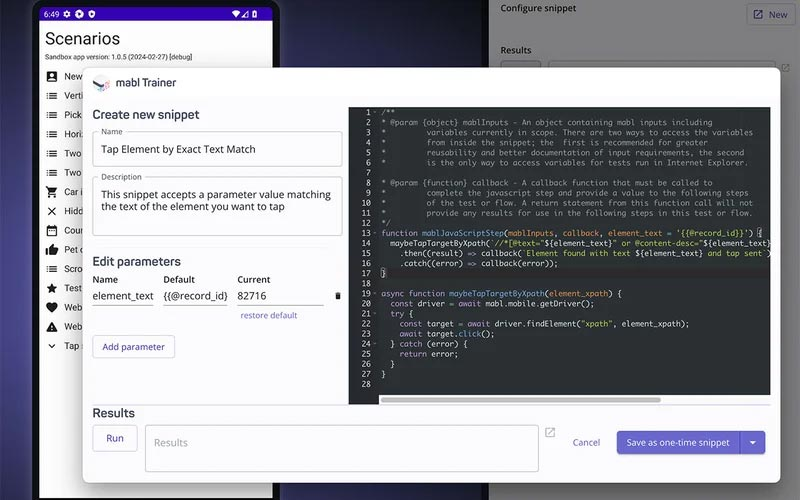

By combining generative AI capabilities, computer vision and machine learning, the company said the new tool enables QA teams to test any mobile applications without new or extensive coding.

This makes the platform ideal for large banks and fintech firms, which constantly update or upgrade their mobile applications as security threats increasingly pose a major issue for financial services firms.

“Ensuring the highest quality software across the entire user experience is critical for financial organisations today,” stressed Dan Belcher, who co-founded Mabl in 2017.

“End user transactions globally occur primarily on smartphones, yet the mobile app testing and deployment process has failed to catch up to the pace of change, and largely continued to be arcane, time-intensive, and highly piecemeal in its focus on the testing experience,” Belcher told QA Financial.

He explained that the solution is able to turn to machine intelligence to eradicate manual selector tasks, thereby speeding up test creation and detect flaws and gaps in test coverage while slowing down any reduction in performance testing.

Moreover, the feature has also been designed to run tests for iOS and Android apps within a few minutes.

“Manual testing is often slow, expensive to scale, and does not capture the full picture of quality across APIs.”

– Dan Belcher

Belcher said there is a clear appetite in the market for testing tools like the firm’s new platform.

Mabl, which is backed by investors such as Vista Equity Partners’ Endeavor Fund, Amplify Partners, Presidio Ventures and CRV, has reportedly seen its monthly test runs triple in the last 12 months, while the company’s API test requests have increased by close to eight times, according to VentureBeat.

This leads Belcher to warn that “financial organisations that don’t put mobile quality front and centre will fail to attract and maintain their user base.”

In fact, he said he has seen “firsthand that firms that embrace AI-powered, automated testing solutions have a competitive advantage, by democratising mobile app testing and accelerating time to market.”

Mabl’s new platform is able to address a number of key issues that are often a major headache for QA teams, such as complex, fragmented and costly scripted test automation tools, an over-reliance on manual testing processes, complicated procedures for deploying apps on marketplaces, as well as a lack of available quality talent.

Belcher is convinced that AI will simply expedite the process, eliminate the need for human intervention, and lower costs.

“Plus, having it be low-code makes quality assurance accessible to both technical users and those who are not,” he added.

“Unified means enterprises can manage their testing strategy across APIs, browsers, devices and web/mobile applications in one centralized platform,” he said.

“This is important because enterprise applications often span multiple interfaces and users benefit from a single low-code solution for all test types, lowering the barrier to entry so that anyone can participate in automation.”

Belcher continued by saying that “despite the fact that mobile applications demand testing at a greater scale across devices and operating systems, most mobile app development teams rely on manual testing for their quality strategies.”

“Manual testing is often slow, expensive to scale, and doesn’t capture the full picture of quality across APIs, performance, and accessibility,” he concluded.

Stay up to date and receive our news, features and interviews for free

Our e-newsletter lands in your inbox every Friday. Sign up HERE in one simple step.

EARLIER THIS MONTH

DO NOT miss coverage of our recent conferences in Chicago and Toronto

READ MORE